Public Agency:

Bond, Consulting or Both:

Practice Areas:

NHA Contributions: Developed a dynamic 30-year financial model for on-street and off-street parking enterprise funds and helped secure “A” credit rating for a rare “pure” parking revenue pledge transaction.

Project Completion: August 2016

NHA Contact: Craig Hill and Mike Meyer

Link to 2016 Bond Buyer Article.

Pictures courtesy of Bond Buyer article.

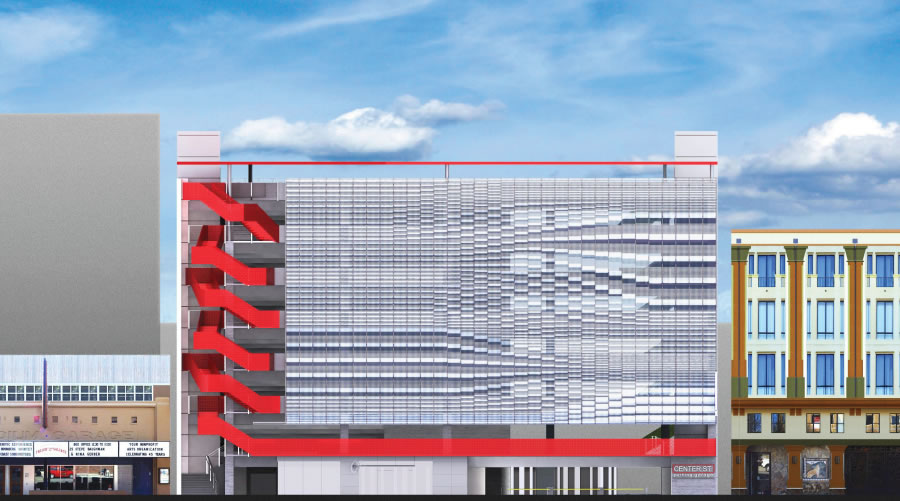

Unique Characteristics of Project: Brand new, $45 million modern, “green” downtown parking garage financed through a combination of cash reserves and parking revenue bonds. No impact to City’s general fund by utilizing a unique parking revenue pledge and creative bond structuring techniques.

Executive Summary: After the culmination of two decades of due diligence by the City evaluating the need for seismic retrofitting, modernization, and expansion needs, it was determined that the aging Center Street Garage would need to be replaced. The new garage has an efficient double-helix design, valet and self-storage for over 300 bicycles, 19 electric vehicle charging stations, rooftop solar panels, high-efficiency LED lighting, and a rainwater collection system to bio-filter and store water for irrigation. In addition, the garage will serve as a micro-grid hub that provides emergency power. The design and engineering for the garage was centered around the need to have sufficient net parking revenues to cover the bonds. A key policy objective was to avoid a pledge of the City’s general fund or additional taxpayer support for the project.

After months of due diligence and financial planning, NHA developed a funding solution that maximized utilization of cash-on-hand ($12 million) to reduce the required bond funded portion ($32 million) and meet optimal coverage targets. NHA helped led the effort to develop a credit that relied upon both parking enterprises of the City, meters and garages, and key security features – such as a cash fund rate stabilization fund (MADS funded at closing) and reserve policy that captures excess net revenues through the construction period. In addition to the security features, NHA focused on the City’s booming downtown business district, strong demographics, and the unique “goBerkeley” parking management program when developing the rating presentation. The bonds achieved an “A” rating from S&P based on the strong credit fundamentals and conservative security features and achieved a 2.94% all-in TIC.