Since the beginning of 2020, over $7 billion of bonds have been issued to restructure CalPERS UAL by approximately 78 different local agencies. About 60 of the issuers have utilized a traditional POB bond structure, with others using a lease or alternative revenue bond structure. 56 of the transactions utilized a public offering sale, with the remainder using a private placement.

The re-emergence of this once dormant market continues to grow in popularity as agencies weigh the benefits of lower interest rates and a more sustainable repayment shape/schedule vs. the risk of CalPERS underperforming on investments, especially in the near term. Relative to other types of municipal bonds, interest rates and credit spreads (a by product of investor demand) have varied widely over the course of the last 18 months, with large swings primarily driven by supply/demand market factors in the taxable pension bond market.

Market Update:

Five of NHA’s clients were in the market over the past month, and while overall interest rates are still historically low (3.0-3.3%), there appears to be growing “investor fatigue” and many of the “go-to” investors are showing waning capacity to purchase more POBs.

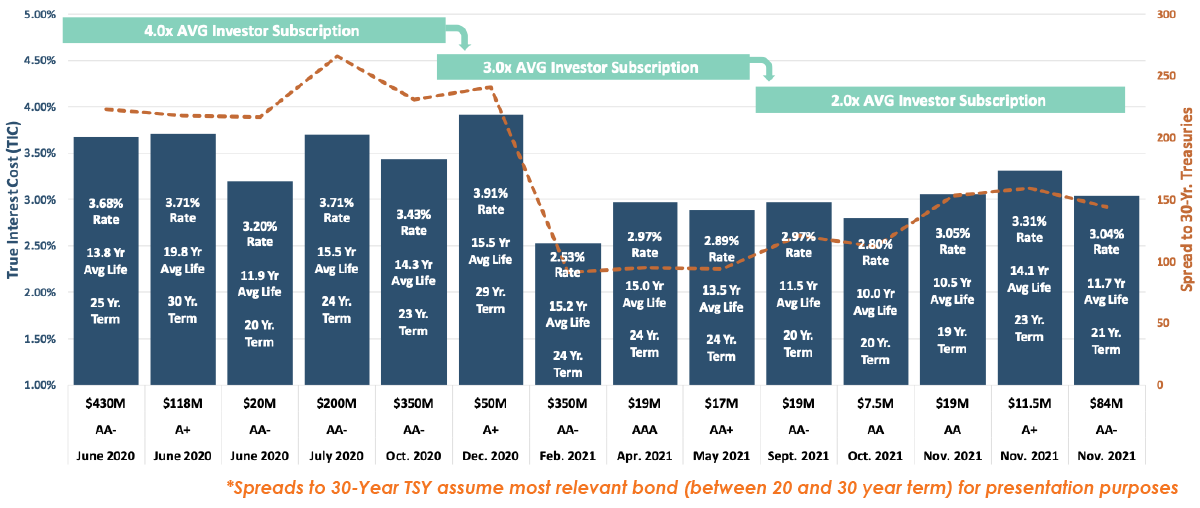

As shown in the sampling above of recent NHA public offering pension deals, interest rates (blue bars) and credit spreads (orange line) have fluctuated widely. Credit spreads (20-25 year pension bond maturity vs. 30-year TSY) started at around the +225 bps last spring, then hit all time lows this past January (<+95 bps) but have jumped quickly back to the +140/150 bps range in recent months given the reduced demand from investors and the Fed’s tapering of its bond purchases.

Also indicative of reduced demand are dropping investor subscription levels for these recent pricings (teal boxes above). It will be interesting to see if there is another market rally in early 2022 (like in 2021) or if the growing wave of pension bonds continues and becomes even more difficult for the market to absorb.

Pension Bonds – Restructuring Flexibility, Future Resiliency, Budgetary Predictability and Cash Flows Savings Remain Core Objectives

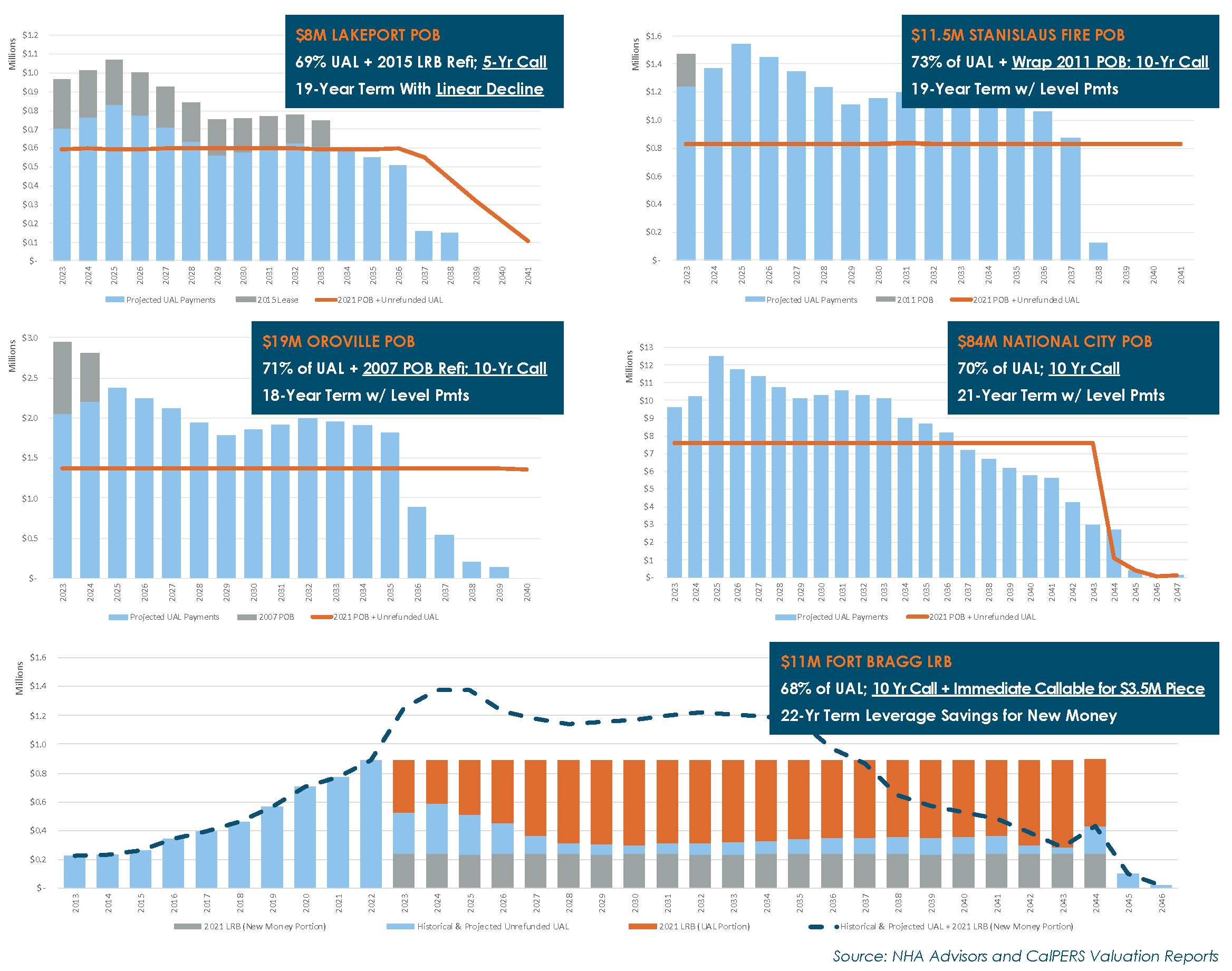

Common Objectives of UAL Restructurings: The ability to re-shape payments in a way that is tailored to individual budgetary goals, constraints, and risk tolerance remains a core benefit. There is no one “one size fits all” approach, as demonstrated in the charts below. The five NHA clients that closed their UAL restructurings in October and November of 2021 all took a different approach when it comes to repayment shape, term (final maturity), % of UAL funded, prepayment flexibility, as well as whether new money was also raised for capital projects. NHA typically recommends a “stress testing” process to quantify the risk of CalPERS investment underperformance and/or future assumption changes.

We encourage all readers to review the results of the CalPERS Asset Liability Management study announcing that the new discount rate will be 6.80%. Combined with significant benefits of the 21.3% returns in FY 2021, nearly all agencies will see a significant reduction in their UAL, with a less “spiking” and shorter UAL repayment shape. All of these impacts should be accounted for when evaluating a potential UAL restructuring strategy.