Spanning our 170+ clients, we’re hearing one common theme: implementing GASB 87 is delaying audits.

Whether you’re nearly done closing the books on FY 2022 or just starting the CY 2022 audit process, this NHAlert outlines three common methods that can help determine the appropriate discount rate to use on your lease assets and liabilities:

Questions? Contact Info@NHAadvisors.com.

This quick reference is meant to assist your agency with the implementation of GASB 87 regarding the reporting of lease liabilities and assets. The three methods for determining the discount rate should be used in the order they are listed below. If you have any questions, we would be happy to discuss your specific situation.

1. Explicit Rate Method

Discount using the explicit rate stated in the lease agreement. This is the best option to use whenever the lease agreement or contract has a stated rate. Unfortunately, this rate is often unavailable.

2. Implicit Rate Method

If there is no rate specified in the lease contract, the next option is to use the implicit rate approach. GASB 87 refences Statement 62 as one resource that can be used. Accordingly, the implicit rate can be defined as the internal rate of return on all payments or receipts related to the lease.

In order to calculate the implicit rate, you will need to know the fair value of the asset (net of any related tax credit), the lessor’s initial direct costs, the unguaranteed residual value, and the annual payment amount.

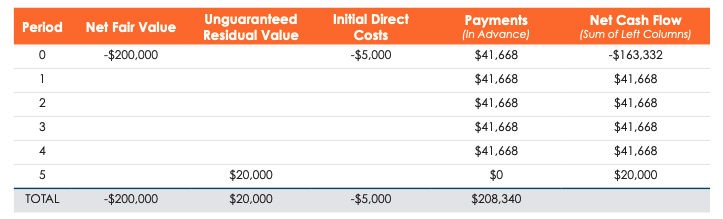

In the example below, we show a lease with a 5-year term that has a net fair value of $200,000 and $20,000 residual value. Indirect costs of the lessor are $5,000 and 5 payments of $41,668 are made in advance (starting in year 0). Negative values in the table above represent outflows, while positive values represent inflows (from the lessor’s perspective). The implicit rate will be the discount rate that makes the net present values of all cashflows equal to zero (the far right column in the table below). If using Excel, use the IRR function and reference the values in the Net Cash Flow column below (resulting in an internal rate of return of 5.02%).

Using the 5.02% internal rate of return calculated in the example above, discount the lease payments and the residual value back to the beginning. The sum of these two values should equal the sum of the fair value of the asset (net of any related tax credit) plus the lessor’s initial direct costs.

One of the key difficulties with utilizing the implicit rate approach outlined above is that lessors are often unwilling to provide information on their initial direct costs. In situations where this information is not readily available, the incremental borrowing rate is the next best option.

3. Incremental Borrowing Rate (IBR) Method:

If the first two methods do not work for your situation, the third method is to calculate the incremental borrowing rate. GASB 87 defines the incremental borrowing rate as:

An estimate of the interest rate that would be charged for borrowing the lease payment amounts during the lease term. (GASB 87, Section 23).

GASB compliance requires use of a rate that is specific to your agency’s borrowing rate. Simply using the corresponding treasury rate or a municipal bond index (e.g., MMD) would not accurately reflect the borrowing rate your agency could expect to receive.

While there is a lot of nuance in determining the borrowing rate, here are some key considerations when determining an appropriate rate:

- Tax Status: Leases that are associated with public use and public access would be considered tax-exempt, while leases that are only used by one private entity would generally be considered taxable. A tax-exempt lease would use a tax-exempt municipal bond index (e.g., MMD, BVAL, etc.) as the starting point; a taxable lease would use treasury rates as the starting point.

- Term: Typically, a yield curve is lower in the early years and higher in the later years. This relationship does not always hold true, especially during periods of high inflation. Accordingly, when calculating the incremental borrowing rate, it is important to match up the term of the lease contract or agreement with the equivalent year on the index yield curve (e.g., treasuries or MMD/BVAL).

- Credit Spreads: Investors add a premium (or “credit spread”) to an index rate to compensate themselves for risk that the issuer defaults. Accordingly, issuers with better ratings will generally have smaller (tighter) credit spreads to the associated index, while an unrated or poorly rated issuer will have a larger (wider) credit spreads.

Generally speaking, to determine your incremental borrowing rate, first determine the anticipated tax status of the lease and then use the appropriate index as your starting point. Then, select a year on that index that correlates to the term of your outstanding lease. Finally, add a credit spread to that selected year to determine a simple incremental borrowing rate.

We understand that there can be other nuances to consider for determining the incremental borrowing rate in your situation, and we would be happy to assist you with that process!

Other Helpful Links:

- CalPERS Commentary: “The Mountain Peak Returns”

- Fall 2021: Pension Bonds – Heavy Issuance Continues…But Are Headwinds Ahead?

- Spring 2021: NHA Pension Bond Market Update

- Fall 2019: Pension Costs – The Ever Changing Landscape

- Winter 2017: CalPERS Discount Rate Reduction and the Impacts on Local Public Agencies

- Spring 2015: Side Fund Pension Bond Savings No Longer Guaranteed by CalPERS