NHA’s January 2023 NHAlert relates to a resurging financial challenge – pensions. Despite very strong CalPERS investment returns in FY 20-21, the negative investment returns in FY 21-22 may mean that the dreaded “mountain peak” of payments is set to return. NHA feels that it will likely impact budgets more significantly than previously projected. CalPERS members are now in a vulnerable position this budget season due to the misleading optics of strong pension valuations reported in recent CalPERS actuarial reports.

For more information, please reach out to our pension group (Pensions@NHAadvisors.com or Mike@NHAadvisors.com) with any questions that you may have.

Impacts of the Recent -7.5% Returns?

As many agencies are likely aware, CalPERS returned -7.5% in investment earnings for FY 2021/22, dropping its funding levels from 82% to 71%. This came on the heels of a 21.3% earnings year in FY 2020/21, effectively giving back the progress made by CalPERS in FY 2020/21. While the benefit (UAL reduction) of the 21.3% return year slightly outweighs the impact (UAL increase) of the negative 7.5% returns, the recent reduction of the discount rate from 7.0% to 6.8% largely offsets any remaining benefit from FY 2020/21. In effect, those agencies that did not issue a POB will probably reencounter a similar UAL balance (likely slightly higher) and funded ratios in next year’s CalPERS 6/30/2022 valuation reports as the ones shown two years prior. Generally speaking, most agencies saw about a 25% to 40% reduction in their UAL after the 21.3% returns in FY 2020/21 and increased funded ratios to 80% or higher. However, those UAL levels are likely to return to prior highs (or higher) based on CalPERS projections, with funded ratios for many non-POB issuing agencies dropping back close to the 70% levels.

The “Mountain Peak” is Coming Back – Where are Payments Heading?

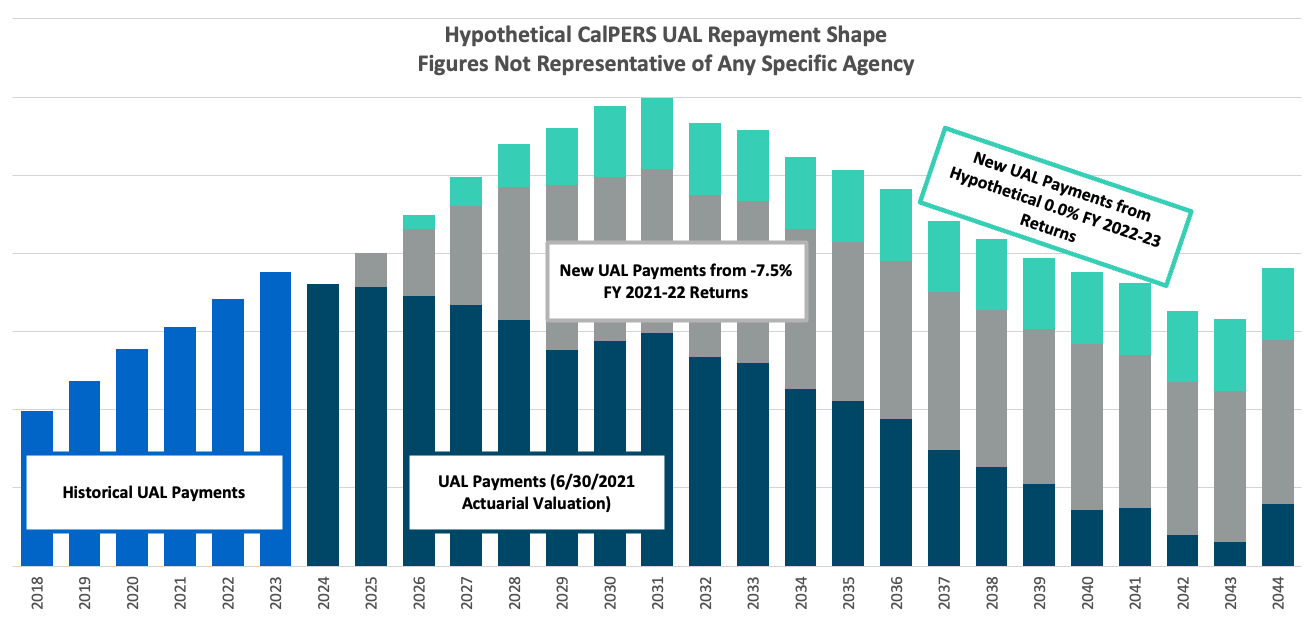

As shown in the hypothetical chart below, the most recent CalPERS valuation reports (6/30/2021) project for a de-escalating UAL repayment shape based on the FY 2020/21 21.3% returns for many agencies (seen in the dark blue bars). However, represented in the stacked grey bars are the additional future UAL payments agencies may expect to see corresponding to the -7.5% FY 2021/22 returns. These, combined with the existing projected payments shown in the dark blue bars, recreate an escalating payment shape that most agencies had previously prepared for prior to 2021. These new total payments for most agencies project to peak around the end of the decade based on the commonly front-loaded structure of CalPERS amortization bases. With volatility in the U.S. bond and stock markets continuing into FY 2022/23, another consecutive fiscal year of underperforming returns is a possibility (CalPERS investment returns through mid-January 2023 have been estimated around 0%). The chart above conceptually shows the hypothetical scale of a 0% investment performance impact for FY 2022/23 on an agency’s UAL amortization schedule. While nominal amounts for each individual agency will differ, the takeaway is that this anticipated “peak” may only grow faster, and to higher levels, if CalPERS doesn’t recover from recent market losses.

As shown in the hypothetical chart below, the most recent CalPERS valuation reports (6/30/2021) project for a de-escalating UAL repayment shape based on the FY 2020/21 21.3% returns for many agencies (seen in the dark blue bars). However, represented in the stacked grey bars are the additional future UAL payments agencies may expect to see corresponding to the -7.5% FY 2021/22 returns. These, combined with the existing projected payments shown in the dark blue bars, recreate an escalating payment shape that most agencies had previously prepared for prior to 2021. These new total payments for most agencies project to peak around the end of the decade based on the commonly front-loaded structure of CalPERS amortization bases. With volatility in the U.S. bond and stock markets continuing into FY 2022/23, another consecutive fiscal year of underperforming returns is a possibility (CalPERS investment returns through mid-January 2023 have been estimated around 0%). The chart above conceptually shows the hypothetical scale of a 0% investment performance impact for FY 2022/23 on an agency’s UAL amortization schedule. While nominal amounts for each individual agency will differ, the takeaway is that this anticipated “peak” may only grow faster, and to higher levels, if CalPERS doesn’t recover from recent market losses.

What’s New in the Actuarial Reports Released in Fall 2022?

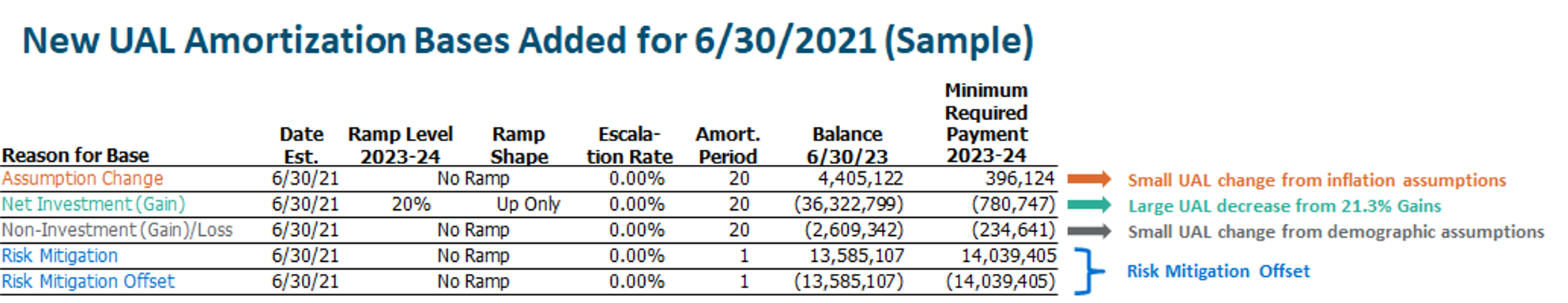

In the most recent CalPERS valuation reports (6/30/2021), NHA believes that most agencies will see several new amortization base layers that reflect the CalPERS ALM Study results and the FY 2020/21 21.3% investment gains. As noted below in royal blue, NHA believes that most agencies will see a rather large offsetting UAL which reflects the risk mitigation policy. Essentially, the impact of the discount rate reduction to 6.8% ($13.6M in example below) will be offset by a portion of the 21.3% gains. The remaining impact of the 21.3% gains are reflected in a significant negative UAL base, shown below in teal (the only base with a “ramped” payment/credit schedule). Other smaller impacts are shown in orange and grey and relate to additional assumption changes (i.e., inflation, mortality) and non-investment gains/losses.

New UAL Amortization Bases Added for 6/30/2021 (Sample)

Source: CalPERS 6/30/2021 actuarial reports

What Happened to the Agencies that Issued POBs?

Approximately 85 to 95 agencies have restructured their UAL through debt financing since the Spring of 2020. NHA has worked with approximately 25 of these agencies and kept abreast of broader market trends. As market timing and re-investment risk are the two largest concerns for giving CalPERS large, lump-sum proceeds to invest at a given time (see our recent pension bond NHAlerts: Dec 2021 & Nov 2019), the past two years of high market volatility have magnified recent gains and losses for pension bond issuers.

For instance, for pension bonds issued in FY 2020/21, the strong gains from that fiscal year were also applied partly to the bond proceeds deposited with CalPERS, which would have reduced an issuer’s UAL (and increased funded ratios) by even more than if such Agency had not issued the bond. Accordingly, the losses from FY 2021/22 will be magnified (and funded ratios will be further lowered) for issuers of pension bonds prior to June 30, 2022. Gains and losses attributable to POB proceeds are based upon the length of time the proceeds are invested with CalPERS so the closing/timing of deposit factors in significantly.

However, from analyzing several cases of pension bond issuances since the Spring of 2020, NHA has found that most, if not all, pension bond-issuing agencies during this time have noted significant benefits from their respective bond issuances, even for those with magnified losses in FY 2022. This net benefit is attributable to the wide differential between the CalPERS discount rate of 6.8% and the interest rates of issued pension bonds, which have generally ranged between 2.5% to 4.5% in recent years. These interest rate spreads created a significant amount of cushion and ability for issuing agencies to withstand CalPERS investment performance volatility, especially in the near term, post-issuance.

However, from analyzing several cases of pension bond issuances since the Spring of 2020, NHA has found that most, if not all, pension bond-issuing agencies during this time have noted significant benefits from their respective bond issuances, even for those with magnified losses in FY 2022. This net benefit is attributable to the wide differential between the CalPERS discount rate of 6.8% and the interest rates of issued pension bonds, which have generally ranged between 2.5% to 4.5% in recent years. These interest rate spreads created a significant amount of cushion and ability for issuing agencies to withstand CalPERS investment performance volatility, especially in the near term, post-issuance.

As an example, many issuers at their transaction close projected robust present value (PV) savings between 20-30% from their pension bond over the term of the financing (commonly 20-25 years). For pension bonds issued in the period after the FY 2021 gain and before the FY 2022 loss (basically, a worst-case market timing), currently estimated PV savings over the term of the financing is likely to drop significantly, possibly to the 10-15% range. These savings still project to be robust by traditional refunding standards, but are now lower than expected at issuance. Agencies who issued in 2020 and/or early 2021 likely will see very little change to expected PV savings, since the FY 2022 losses are largely offset by the extremely strong gains of FY 2021. Issuers of POBs who closed in very late in FY 2022 won’t see any significant magnification of losses since POB proceeds were only on deposit with CalPERS for a brief part of the fiscal year. As noted before, the timing of the deposit of proceeds to CalPERS impacts these nuanced calculations in significant ways, so it is difficult to broadly analyze the performance of all POBs without taking all these factors into account. Of course, the actual PV savings/cost won’t truly be fully realized until the final term of the bonds in all of these cases.

In addition, one of the key benefits of UAL restructurings, the ability to smooth over an Agency’s projected UAL payment peaks to lower payment levels, has helped issuers be in a more advantageous cash flow position for the next several years, with lower total pension-related payments post-issuance, even if their pension bond was subject to magnified recent losses.

Many pension bond issuers, though policy adoption, also have strategically used guaranteed near-term savings from their pension bond to fund reserves to higher levels, often via a Section 115 Trust dedicated to pensions. This balance sheet asset can function as a shock absorber and fiscal sustainability tool when rising pension payment increases are projected to impact the budget in a few years.

Certain pension bond issuers may also notice a large reduction in payments for FY 2024 and FY 2025 if they received the timing benefit of FY 2021 gains. While this is a great result for those issuers, NHA would encourage these agencies to continue budgeting conservatively and utilizing such savings to continue addressing pension costs in light of the impending UAL increases – either through funding of 115 Trusts, ADPs to CalPERS, or other cost management strategies.

Are Pension Bonds Dead?

With long-term taxable interest rates for pension bonds currently between 5.25% and 6.00% (estimated range), UAL restructurings are not quite penciling when it comes to assessing the risk/reward, in the opinion of NHA. Through June of 2022, some financial institutions had offered direct placement rates in the low 4% range, however rates in the placement market rapidly caught up to those in the public offering marketplace in late 2022. The window for strategic UAL restructuring financings may open again in the future, and agencies may want to periodically monitor the viability of this strategy. As always, NHA recommends undertaking a comprehensive risk evaluation and stress testing process when assessing if a UAL restructuring is a meaningful approach for any Agency, and what type of structuring considerations (i.e. size, term, shape, security) might be suitable, if any. This risk assessment is highly sensitive to the current interest rate market and future investment returns and requires a thorough evaluation so that these risk/reward calculations can be translated for and understood by elected officials and stakeholders.

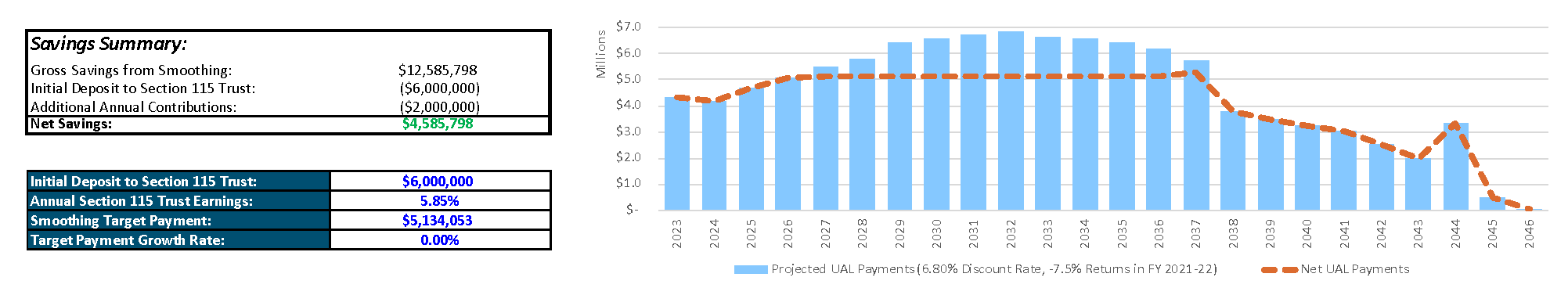

Using ADPs or Section 115 Trusts to Smooth the Peak

For most agencies, their projected UAL payments are expected to remain at current levels (or even drop if a pension bond was issued) for a few years, before ramping quickly. We encourage agencies, through good policy development and stakeholder education to leverage this extra budgetary capacity to consider additional discretionary payments to CalPERS and/or bolster reserves (i.e. Section 115 Trust) to serve as a shock absorber in future years.

Source: CalPERS 6/30/2021 actuarial reports

NHA works with many of its clients to develop ADP and Section 115 “smoothing models” so that our clients have a real-time, dynamic way of modeling out the potential benefits of various strategies. This analysis often helps policy decision making by enabling agencies to quantify the benefits of setting aside more cash for pension costs, and modifying key assumptions (earnings rate, up front and annual deposit amounts, timing of withdrawals) in real time to quickly understand the impacts of different types of funding strategies. For some agencies with more abnormal UAL payment shapes caused by recent volatility and/or POB issuances, it may be necessary to contact your CalPERS actuary to determine and/or modify a new amortization schedule.

Strategic Use of Cash Reserves – Fund Capital or Pay Off UAL?

When evaluating strategies to tackle the pension UAL, the largest debt for the majority of California agencies, it is critical that a holistic view of all priorities is included. This includes the maintenance of liquidity (reserve levels), long term resiliency and sustainability and optimal funding of CIP. Evaluating best practices to address these priorities begins with fundamental fiscal sustainability – long term forecasting to evaluate the viability of certain strategies, various opportunities and limitations. Once a thorough assessment of strategies is undertaken, a comprehensive funding solution can be executed. For many agencies, strategically using reserves to address their highest interest rate debt (i.e. the 6.8% CalPERS UAL) is a potential consideration. As a holistic CIP funding strategy, some agencies with the ability to do so can repurpose CIP reserves towards paying down their 6.8% CalPERS UAL debt and then finance capital projects at lower tax-exempt interest rates, which currently range from 3.25% to 4.25% for longer-term debt. This strategy could enable Agencies with significant reserves to fund capital projects while effectively refinancing higher costing debt. Many other forms of funding sources for CIP are out there as well, including low interest subsidized loans, grants, banks loans and internally held reserves.

Education, Planning and Policy Driven Solutions is Crucial!

While many agencies have done a tremendous job in educating their stakeholders about CalPERS costs in recent years, recent CalPERS investment return volatility in tandem with the inherent lag in the CalPERS valuations data currently show UAL balances for Agencies as artificially low, and funded ratios high, when only looking at the recent actuarial reports. As such, it will be critical for Agencies to stay educated about impending UAL increases in the years following FY 2023. This discrepancy, combined with a risk of a potential recession or general economic slowdown, means that agencies and their stakeholders may want to take a conservative approach when making key budgetary decisions and/or negotiating new contracts in the near future. NHA encourages our clients to utilize the free Outlook Tool provided by CalPERS. This tool provides agencies with a simple, user-friendly and dynamic way to project out costs using a host of different assumptions. The simple Excel output makes is easy to mesh these projections with your other General Fund and Utility Fund projection models. Over the past several years, the development of pension funding policies is occurring more and more across the state. While these policies are looked upon favorably by credit rating agencies, investors and lenders, they also memorialize long-term strategy and provides a roadmap for tackling this challenge with a variety of strategies.

How do I Compare to Other Agencies?

CalPERS has made great strides in improving transparency and user-friendly tools over the years. The link below is a recent document published that provides UAL and Funded Ratio information for every CalPERS member.

Conclusion

In closing, if you have any questions related to CalPERS, please don’t hesitate to reach out to NHA’s Pension Group. We would be happy to discuss our work in this realm or put you in touch with other experts or agencies that might be helpful for whatever your needs may be. Our core work with our pension clients includes policy development, stakeholder education, projection/modeling, risk assessment and cost management strategy evaluation and execution. NHA prides itself on translating complex information to our clients and stakeholders so that decisions can be made with eyes wide open and from a common level of understanding. NHA does not offer cookie cutter modeling, but adapts our materials, reports, models, analysis, and policy in a highly efficient and responsive way to meet the varying needs of our public agency clients and their stakeholders.

For more information, please reach out to our pension group (Pensions@NHAadvisors.com or Mike@NHAadvisors.com) with any questions that you may have.

Other Helpful Links:

- Fall 2021: Pension Bonds – Heavy Issuance Continues…But Are Headwinds Ahead?

- Spring 2021: NHA Pension Bond Market Update

- Fall 2019: Pension Costs – The Ever Changing Landscape

- Winter 2017: CalPERS Discount Rate Reduction and the Impacts on Local Public Agencies

- Spring 2015: Side Fund Pension Bond Savings No Longer Guaranteed by CalPERS